ODI & FDI- FEMA/ RBI (OVERSEAS AND FOREIGN DIRECT INVESTMENT)

RBI/ FEMA- Investments made from India and into India–ODI/ FDI

Considering the severe penalties on procedural lapses and strict interpretation of foreign exchange laws by the judiciary, one which has a close connection commercially with India such as Mauritius, Singapore, or Dubai, the ODI and FDI are interlaced and have given birth to a new notion called “Externalisation”.

INTRODUCTION

In the fiscal year 2023, India saw a significant increase in Outward Direct Investment (ODI) by Indian firms, as well as a surge in inward Foreign Direct Investment (FDI), according to a census conducted by the Reserve Bank of India (RBI).

Overall ODI Growth:

Overall FDI Growth:

(Figures in US$ Million)

| Financial Year | FDI Equity Inflow |

| 2021-22 | 58,773 |

| 2022-23 | 46,034 |

| 2023-24 UPTO (SEPT- 23) | 20,488 |

The complex structure of externalization raises complicated questions before the professionals/ CA, who shall deep dive into the nuances of the foreign exchange laws, rules, regulations and directions intertwined with the compliances under the company laws, rules and secretarial procedures thereunder

- How the structuring of outbound investments into entities incorporated abroad in a regulatory friendly jurisdiction can be made, considering the possibilities under overseas investment rules, regulations, and directions.

- Constructing cap-tables with ordinary equity shares be issued or shares to be considered on a fully diluted basis like Compulsorily convertible preference shares or debentures be issued within the purview of FDI norms in India.

- Practical insights into the actual steps and good secretarial practices to be followed while making ODI or receiving FDI.

- Tip to root reporting with forms to filed, what disclosures to be made, within what timelines and whether physical/ online reporting to be made through authorised dealer banks (AD Bank) under various portals.

- Finding ways to resolve non-compliance, contravention and violation, under the foreign exchange laws either by paying late submission fees or compounding fees to ensure complete compliance.

- How India has grown to be a global financial hub to confer benefit on shares issued in India or abroad with options for listing outside India, while in India.

Summing up, it is an interpretation and scope galore for professional/CA to construct and give meaning to the above foreign exchange aspects of investments.

ODI – RBI/ FEMA RULES AND REGULATION

Overseas Direct Investment means an investment made by an Indian Party in Joint Ventures (JV) or Wholly Owned Subsidiaries (WOS) outside India either by Automatic Route or Approval Route. Direct investment outside India i.e. ODI Compliance in India is governed by Foreign Exchange Management (FEMA Regulations).

Routes for Overseas Direct Investment

Overseas Direct Investment can be done via two routes

- Automatic Route

- Here no prior approval from the RBI is required.

- The ODI via Automatic Route is processed by Authorized Dealers Bank.

- Approval Route

- The Overseas Direct Investment via Approval Route requires prior approval from RBI before it is processed by Authorized Dealers.

Prohibited Activities under Overseas Direct Investment

- An Indian Individual / Party cannot make Overseas Direct Investments in Real estate, Banking Business.

- The ODI cannot be made for dealing in Financial products linked to INR without specific approval of RBI

- Note: Buying and selling real estate and dealing in TDR (does not include township, residential and commercial premises, roads and bridges)

Preliminary Requirements for ODI

No Objection Certificate (NOC) with AD Bank Before venturing into ODIs, individuals or entities that are defaulters with any bank, the Central Bureau of Investigation (CBI), Enforcement Directorate (ED), or Serious Fraud Investigation Office (SFIO) must secure a No Objection Certificate (NOC) from an Authorized Dealer (AD) Bank. This is a mandatory clearance to ensure that individuals or companies with adverse financial or criminal histories do not engage in foreign investments.

Form ODI FC and Unique Identification Number (UIN)

Form FC, replete with requisite documentation, must be submitted to the AD Bank for acquiring a Unique Identification Number (UIN). The UIN acts as a unique identifier for the Indian entity making the investment, enabling the RBI to track the transaction. The AD Bank, after due verification, will process the transactions only upon the issuance of this UIN

Post Investment Compliances:

The Indian Party shall:

- Receive share certificates/ any other documentary evidence of investment in the overseas JV / WOS and submit the same to the designated AD within statutory time limit

- Repatriate to India, all dues receivable from the overseas JV / WOS, like dividend, royalty, technical fees, etc.

- File APR Form ODI in respect of each JV or WOS outside India set up or acquired by the Indian party by 31 December every year

- Report the details of the decisions taken by a JV/WOS regarding diversification of its activities /setting up of SDS/change in its shareholding pattern within 30 days

- On disinvestment repatriate the sale proceeds immediately or not later than 90 days from the date of sale of the shares /securities

- File Foreign Liabilities and Assets (FLA) return every year by 15 July if applicable

ODI & FDI -FEMA /RBI

RBI/ FEMA- Investments made from India and into India–ODI/ FDI

Considering the severe penalties on procedural lapses and strict interpretation of foreign exchange laws by the judiciary, one which has a close connection commercially with India such as Mauritius, Singapore, or Dubai, the ODI and FDI are interlaced and have given birth to a new notion called “Externalization”.

Introduction

In the fiscal year 2023, India saw a significant increase in Outward Direct Investment (ODI) by Indian firms, as well as a surge in inward Foreign Direct Investment (FDI), according to a census conducted by the Reserve Bank of India (RBI).

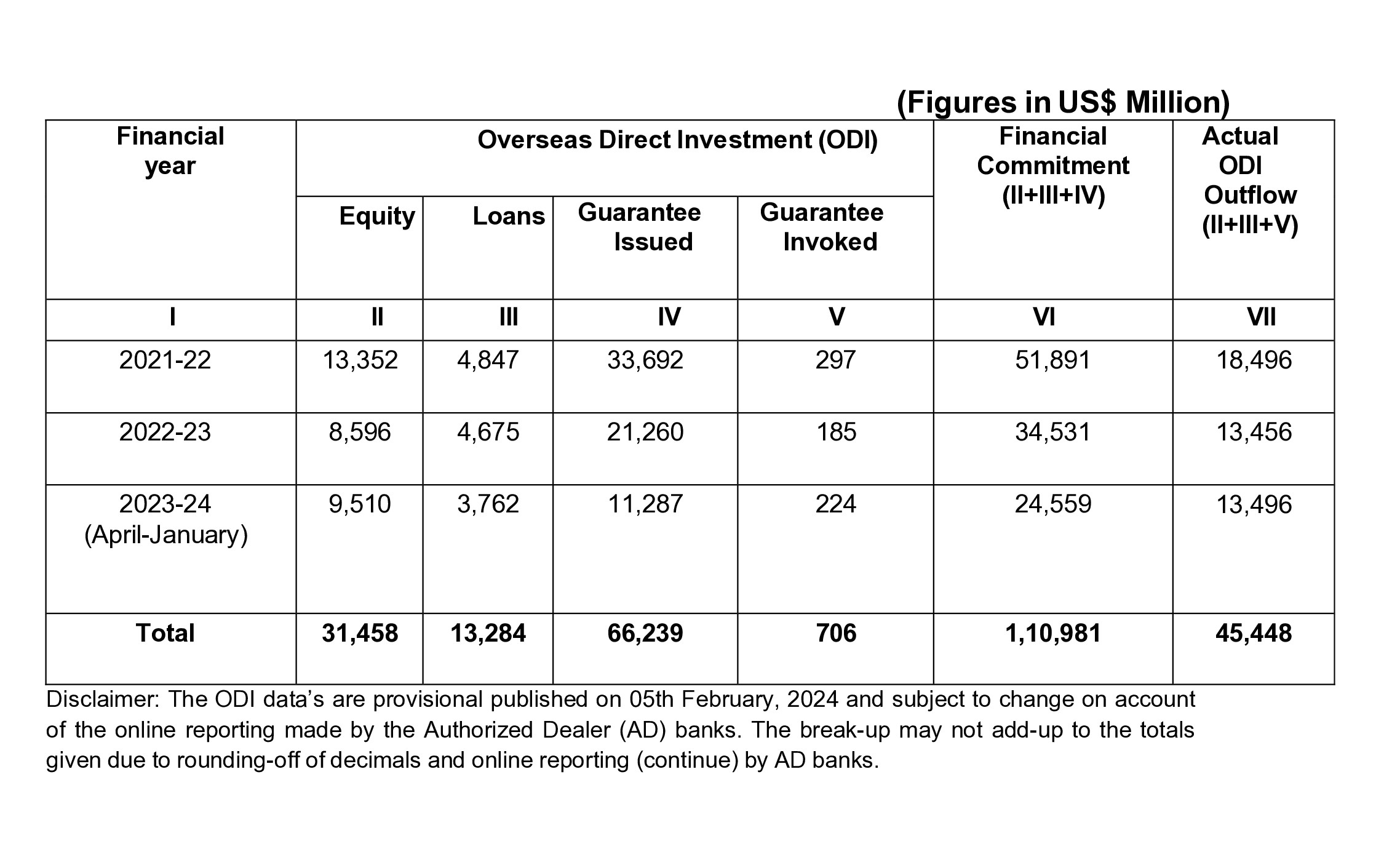

Overall ODI Growth:

(Figures in US$ Million)

|

Financial Year |

Overseas Direct Investment(ODI) |

Financial Commitment (II+III+IV) |

Actual ODI Outflow (II+III+v) |

|||

|

Equity |

Loans |

Guarantee Issued |

Guarantee Invoked |

|||

|

I |

II |

III |

IV |

V |

VI |

VII |

|

2021-22 |

13,352 |

4,874 |

33,692 |

297 |

51,891 |

18,496 |

|

2022-23 |

8,596 |

4,675 |

21,260 |

185 |

34,531 |

13,456 |

|

2023-24 (April-January) |

9,510 |

3,762 |

11,278 |

224 |

24,559 |

13,496 |

|

Total |

31,458 |

13,284 |

66,239 |

706 |

1,10,981 |

45,448 |

Disclaimer: The ODI data’s are provisional published on 05th February, 2024 and subject to change on account of the online reporting made by the Authorized Dealer (AD) banks. The break-up may not add-up to the totals given due to rounding-off of decimals and online reporting (continue) by AD banks.

Overall FDI Growth:

(Figures in US$ Million)

|

Financial Year |

FID Equity Inflow |

|

2021-22 |

58,773 |

|

2022-23 |

46,034 |

|

2023-24 UPTO (SEPT-23) |

20,488 |

Disclaimer: FDI Statistics provided by DPIIT

The complex structure of externalization raises complicated questions before the professionals/ CA, who shall deep dive into the nuances of the foreign exchange laws, rules, regulations and directions intertwined with the compliances under the company laws, rules and secretarial procedures thereunder

- How the structuring of outbound investments into entities incorporated abroad in a regulatory friendly jurisdiction can be made, considering the possibilities under overseas investment rules, regulations, and directions.

Constructing cap-tables with ordinary equity shares be issued or shares to be - considered on a fully diluted basis like Compulsorily convertible preference shares or debentures be issued within the purview of FDI norms in India.

- Practical insights into the actual steps and good secretarial practices to be followed while making ODI or receiving FDI.

- Tip to root reporting with forms to filed, what disclosures to be made, within what timelines and whether physical/ online reporting to be made through authorized dealer banks (AD Bank) under various portals.

- Finding ways to resolve non-compliance, contravention and violation, under the foreign exchange laws either by paying late submission fees or compounding fees to ensure complete compliance.

- How India has grown to be a global financial hub to confer benefit on shares issued in India or abroad with options for listing outside India, while in India.

Summing up, it is an interpretation and scope galore for professional/CA to construct and give meaning to the above foreign exchange aspects of investments.

ODI – RBI/ FEMA RULES AND REGULATION

Overseas Direct Investment means an investment made by an Indian Party in Joint Ventures (JV) or Wholly Owned Subsidiaries (WOS) outside India either by Automatic Route or Approval Route. Direct investment outside India i.e. ODI Compliance in India is governed by Foreign Exchange Management (FEMA Regulations).

Routes for Overseas Direct Investment

Overseas Direct Investment can be done via two routes

1. Automatic Route

- Here no prior approval from the RBI is required.

- The ODI via Automatic Route is processed by Authorized Dealers Bank.

2. Approval Route

- The Overseas Direct Investment via Approval Route requires prior approval from RBI before it is processed by Authorized Dealers.

Get In Touch With Abhangi & Abhangi LLP

Don’t Wait, just ask We are just click away to discuss your business and find out how best we can serve you